Is it necessary to have a high risk merchant account at highriskpay.com? If you are running a pawn shop, check cashing services, travel agencies, or other risky businesses, having a high risk pay merchant account is helpful.

Businesses with high risks may have a high turnover or increased risk of fraud. For these reasons, having a high-risk merchant account at high-riskpay.com is almost necessary for these businesses. Also, banks employ strict rules and requirements when offering highriskpay merchant account services. In some cases, banks may even decline to provide the service.

If you want to learn more about high risk merchant highriskpay.com, we suggest you read this article.

What Is A High Risk Merchant Account At Highriskpay.com?

Before delving deeper into further details, it is essential to learn what a high risk merchant account at highriskpay.com, is.

A high risk payment processor, highriskpay.com is like a particular type of business bank account. It’s mainly for businesses that do a lot of transactions and might have a higher risk of fraud. With this kind of account, companies can try to lower the costs when things go wrong, like when customers dispute charges or fraud.

However, getting a high risk credit card processing highriskpay.com can be challenging because banks might say no more often. It’s usually the case for businesses that sell things online because they don’t have physical stores.

These high risk merchant accounts are there to help businesses be safer when they sell online. They are for people who want to ensure their companies and websites are protected from fraud, and you can still use these accounts to make credit card payments.

Also see: Kanye West’s New Wife Bianca Censori: Age, Details & Net Worth

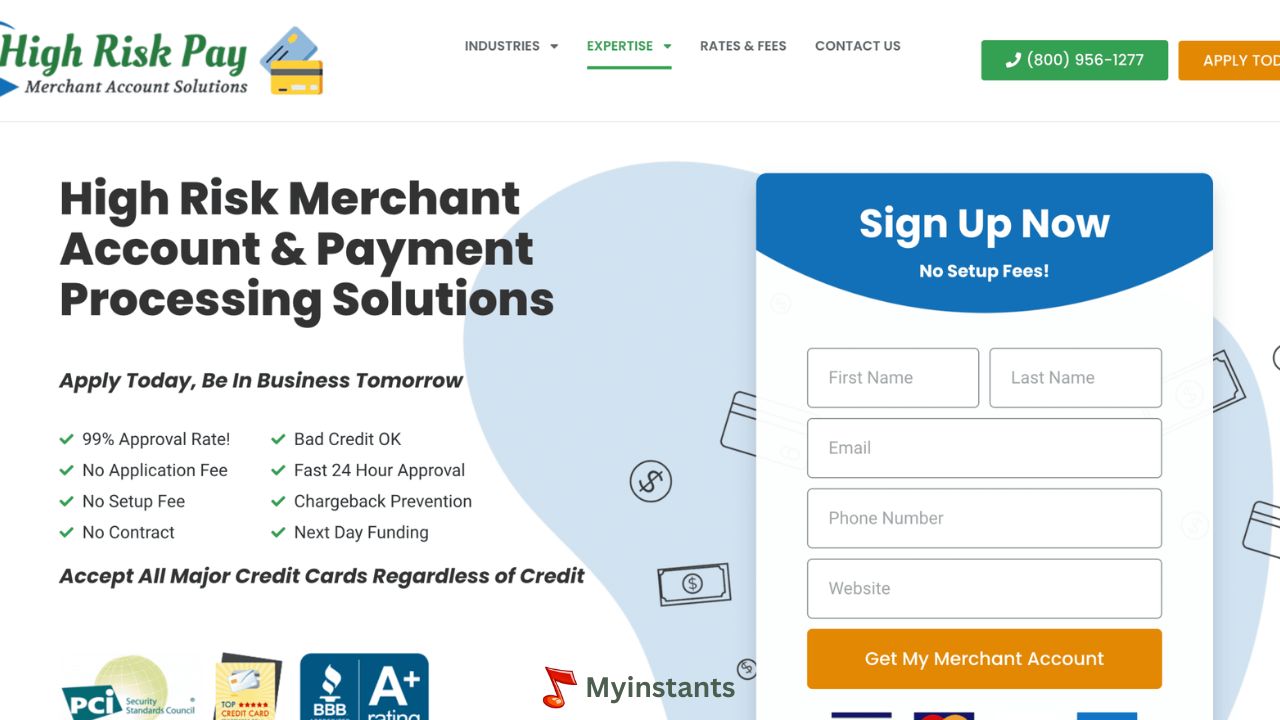

About Highriskpay.com

Now that you know what a high risk merchant account is, let’s give you a brief overview of CBD payment processor highriskpay.com.

When you run an online business and your company is seen as risky, you can expect to face issues. But with high risk merchant highriskpay com, you can turn that scary journey into a thrilling adventure!

This website offers excellent services to businesses that other banks might avoid. It’s like a safe harbor for those who need high-risk merchant accounts.

High risk merchant processors highriskpay.com knows its stuff regarding different industries and their needs. They work with other businesses, like those in adult entertainment, vaping, and CBD, which are often seen as risky. Businesses choose them because it’s easy to get started with them. High risk merchant account high-riskpay.com, does not just talk – they are all about being transparent with prices, giving excellent customer service, and making plans that fit each business perfectly.

Importance Of High Risk Merchant Account Important For Businesses

Why is high risk merchant account instant approval necessary for business? Allow us to explain it to you!

Many businesses need a high-risk merchant account to handle credit card payments from their customers. Highriskpay.com gives them what they need through merchant service providers who know how to work with risky businesses.

These highrisk merchant accounts are handy for many industries, like travel, adult content, e-cigarettes, telemarketers, debt collectors, and businesses that need regular payments.

High risk instant merchant accounts help businesses immediately take credit and debit card payments from customers for online sales and secure payment gateways. They help companies to sell more, make customers happier, and stop fraud. Plus, these businesses can use special tools to keep customer info safe.

Instant merchant accounts might charge more for processing credit cards if they think your business is risky. These charges can include monthly fees and needing to keep money in reserve. They decide how risky your business is by looking at what you do, how many transactions you have, and your credit history.

Paying these fees is important because it helps keep the merchant service providers safe from losing money and keeps them from getting a bad name. To avoid these fees or make them smaller, businesses must be careful when doing transactions. If something shady happens, it could cost them money and hurt their reputation.

To stop chargebacks, businesses must be innovative about charging customers and pick a good credit card processor. They also need to read contracts to ensure they follow all the rules affecting their business.

So, now you know why high-risk merchant account instant approval is essential for businesses. It helps them with various things, enabling them to continue their business with fewer worries.

Also see: Taylor Swift And Travis Kelce Relationship & Trip Details

Things You Need To Apply For A High Risk Merchant Account

Regarding high-risk merchant account instant approval and high-riskpay.com, you need certain things, and we will tell you about them in this section.

You must meet specific requirements to apply for an instant approval merchant account. Some of the documents you will need to provide are:

- A valid driver’s license.

- Proof of insurance coverage must detail the effective date and policy type.

- Personal Identification Number (PIN) is used mainly when using online banking credentials at a drive-through facility or an ATM.

- Business Registration Information may include documents such as partnership agreements, Articles of Incorporation, limited liability company contracts, or other paperwork demonstrating that you are a legitimate business entity.

How To Find The Right High Risk Merchant Account Provider?

Finding a high-risk payment gateway provider can be challenging, but it is possible. To help you, we have listed the factors you must consider when choosing a high-risk payment account provider.

- Experience and Reputation

It would help if you always prioritized merchant account high risk providers with a solid track record and a positive reputation within the industry. For this, you must evaluate their experience and check customer feedback. It would help if you also enquired about any certifications or accolades they might have earned.

- Fees

You must thoroughly review the provider’s fee structure and ensure you understand the costs involved. It is even better to compare these fees with other providers’ fees to ensure fairness.

- Approval Rate

Another essential thing to check is the high risk gateway provider’s approval rate. A high approval rate suggests their willingness to accommodate businesses operating in high-risk sectors or with factors like poor credit.

- Customer Support

Assessing the quality of customer support provided by the high risk merchant service is also essential. Look for high-risk payment processing providers offering cooperative and responsive assistance so you can solve your queries and issues quickly.

- Integration Options

If you require specific integration capabilities, such as compatibility with your accounting software or e-commerce platform, verify that the high risk payment processor offers suitable solutions.

By following these guidelines, you should be able to find the right high risk merchant account provider for your business.

Also see: What Sound Does A Fox Make & How Does It Sound Like?

Tips For Success With A High Risk Merchant Account

Having a high risk merchant account at highriskpay.com means you are in a business that banks consider risky. Here are some tips to succeed with a high-risk merchant account:

- Understand why your business is considered high risk. It could be because of chargebacks, legal regulations, or industry reputation.

- Look for a payment processor or bank that specializes in high-risk accounts. They will understand your needs better and offer services tailored to your business.

- Be honest about your business practices and potential risks, and provide all necessary documentation your provider requests.

- Prevent chargebacks by offering excellent customer service, clear refund policies, and fraud prevention measures.

- Look for any signs of fraudulent transactions or unusual activity and report them immediately.

- Offer multiple payment options to your customers. This can help reduce the risk of losing sales if one payment method becomes unavailable.

Also see: Myinstants – Meme SoundBoard & Sound Buttons

Final Words

A high risk merchant account at highriskpay.com serves as a lifeline for businesses operating in industries prone to more significant risks. While it may come with higher fees and stricter regulations, it provides a hoard of essential services. By understanding the intricacies of high-risk merchant accounts, you can make an informed decision and choose the right provider.

FAQs

What is a high-risk merchant account?

A high-risk merchant account is a type of bank account for businesses considered risky by banks and payment processors—for example, travel agencies, pawn shops, CBD, and the adult industry.

Is high-risk pay legit?

Yes, High-Risk Pay is 100% legit and trusted by many businesses. To better understand the quality of their services, you should check customer reviews.

What is a merchant account website?

A merchant account website is an online platform provided by a payment processor or a bank where merchants can manage their accounts, process payments, view transaction history, and access other related services.

How do I close my merchant account?

Contact your bank or payment processor’s account management team to close your merchant account. They will guide you through the process and get your account closed.

What is a high-risk transaction fee?

A high-risk transaction fee is an additional charge imposed by payment processors or banks for processing transactions deemed to be high-risk.

Why do you need a high risk merchant account?

You might need a high-risk merchant account if your business operates in industries prone to chargebacks, fraud, or regulatory scrutiny.

For more such interesting content, keep reading Myinstants Blog.

Awesome! Its genuinely awesome piece of writing, I have got much clear idea on the topic

of from this post.